The 2025 Budget Bill changed the game

2026: The Year of the 1-2 Year ROI

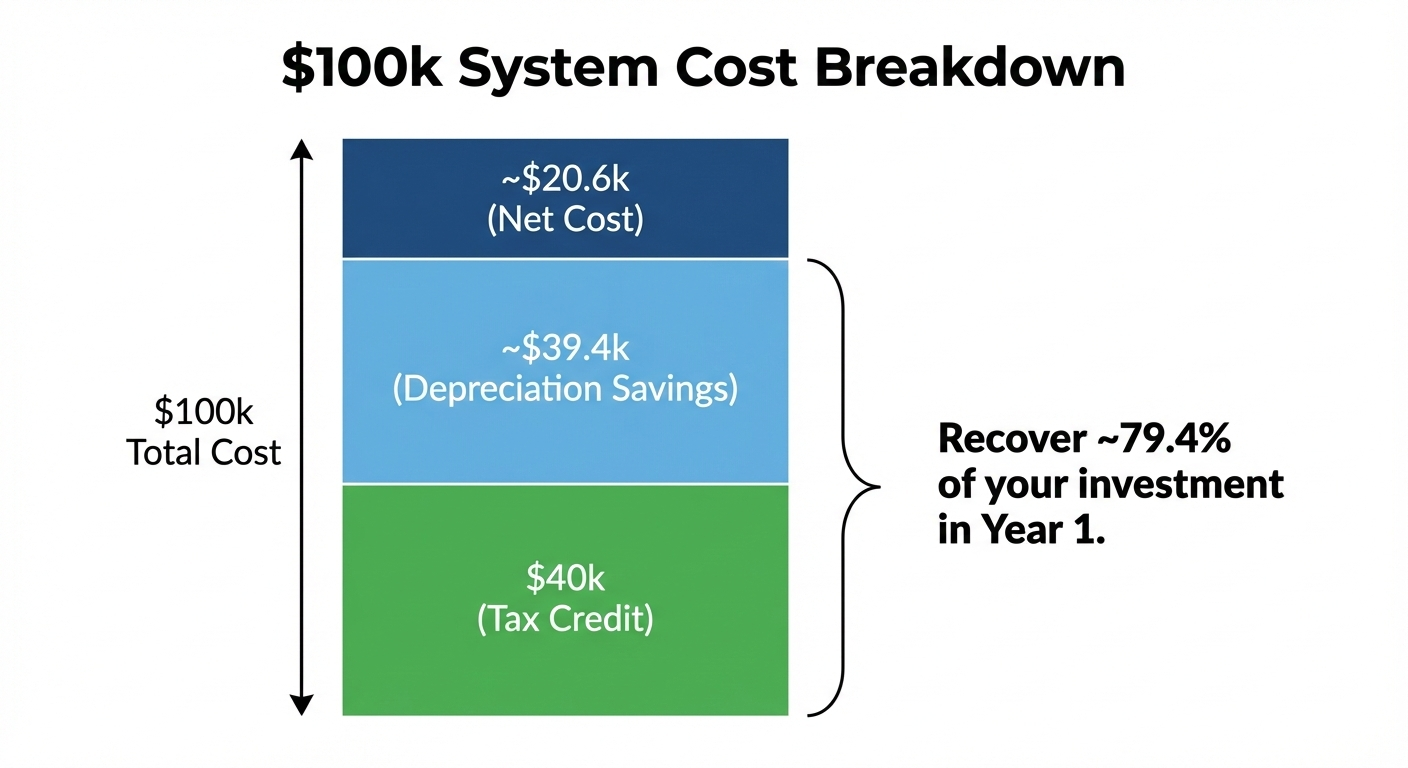

For a limited time, two powerful incentives overlap to cover up to 80% of your system costs:

40% Investment Tax Credit (ITC): Available until July 4, 2026.

100% Bonus Depreciation: Restored immediately, allowing you to expense the full cost in Year 1.

See IRS Guidance on Investment Tax Credits (Section 48)

See IRS Guidance on Bonus Depreciation

LEARN ABOUT THIS GOLDEN WINDOW OF SOLAR

Good news: Battery tax credits aren't going anywhere. Since these incentives are locked in until 2033, you can focus on your solar installation now and easily add storage later without missing out on the savings.

Don’t Build by July 4th —Just Start The Process.

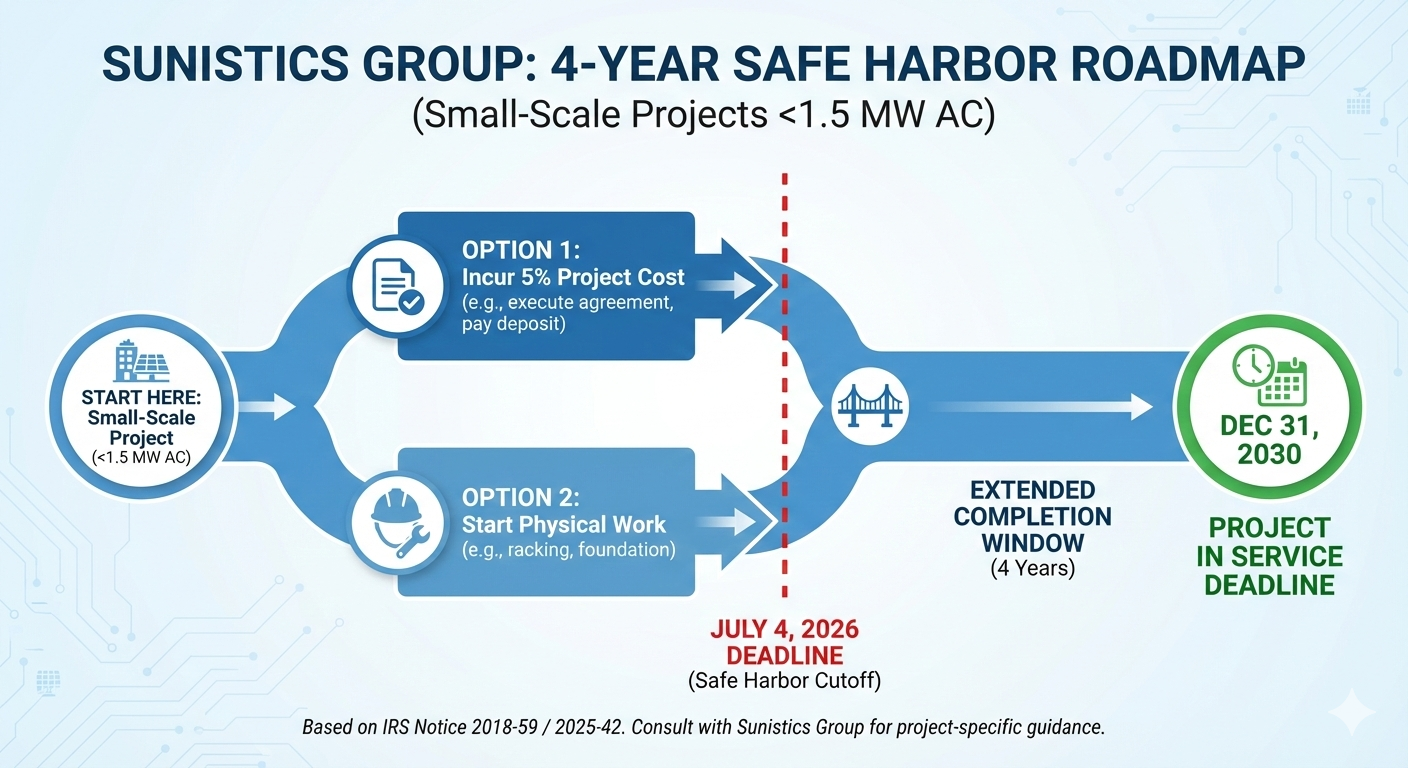

How to "Safe Harbor" Your 40% Credit for 4 Years

You can lock in the 40% tax credit without rushing construction.

According to IRS Notice 2018-59 / 2025-42, small-scale projects (<1.5 MW) can establish the "Beginning of Construction" simply by incurring costs.

The 5% Rule: Execute an agreement and incur 5% of project costs (e.g., system design/engineering) by the deadline.

The Benefit: Once Safe Harbored, you have 4 years (until Dec 31, 2030) to place the project in service.

Projects starting in 2026 must use equipment that is Non-FEOC Compliant

(Free of components from China, Russia, Iran, or North Korea).

Why Waiting Until July is Too Late

With the industry rushing to lock in incentives,

utility and permitting bottlenecks are inevitable.

Start the process no later than May 15, 2026.

This ensures your paperwork is submitted to the utility before the window closes.

Faith-Based Orgs & Non-Profits

You are eligible for the 40% via 'Elective Pay' (Direct Pay), receiving the credit as a cash refund.

You must meet the same Safe Harbor deadlines.

Have questions about Safe Harbor?

Future-Proof Your Business with Our Solar Solutions

COMMERCIAL SOLAR

Solar has long since been the best investment a business can make.

Typical ROI is about three years due to major tax credits and big savings on electricity bills. Right now, these savings can be as much as 80%, but with changes coming to California these numbers might not be around for much longer.

Energy Storage

Power outages can be costly events and have increased in frequency by 38% since 2020.

We provide the best, custom Energy Storage Systems (ESS) and battery backup to increase the resilience of your business.

Typical ROI is currently about 1-2 years due to major tax credits and big savings on electricity bills. Right now, these savings can be as much as 80%, but with changes coming to California these numbers might not be around for much longer.

Industry Expertise

From large corporations and SMBs, to nonprofits and faith-based organizations, we’ve worked with a range of customers across the West Coast to bring sustainability, energy resilience, and significant cost savings to their operations.

Yoshimura R&D INC

Chino, CA

671 KW

19M lbs of CO2 Emissions Reduced

3 Year ROI

Hillside Memorial

Culver City, CA

337 KW

10M lbs of C02 Emissions Reduced

3 Year ROI

Big Brand Tire & Service

Camarillo, CA

98 KW

5M lbs of C02 Emissions Reduced

3 Year ROI

Here’s How We Stack Your Savings: Solar + Tariffs + Efficiency

50% Solar Savings

Solar energy fed into your business is much cheaper than importing it from the grid.

20% Savings from Solar Tariff

The right tariff accounts for the time-of-use in a way that makes sense for you.

10% Savings in Energy Efficiency

Our analysis finds areas where savings can be made in the day-to-day usage patterns.

We Find Every Opportunity To Save On Your Energy Costs

Save Big With Our Sustainability Roadmap

At Sunistics, we don’t just install solar, we guide your full path to energy independence. Our Sustainability Roadmap analyzes over 35,000 data points to uncover your biggest energy drains and recommend targeted solutions.

✅ Custom to Your Facility – Built around your usage and goals

✅ Data-Driven Insights – Focused on reducing your highest costs

✅ Beyond Solar – Includes efficiency upgrades, storage, EV charging & more

✅ Turnkey Service – We manage everything, start to finish

The result: lower energy bills, higher property value, and measurable sustainability gains.

Get Started Today in Three Easy Steps

Step 1: 5-Minute Online assessment

- Review premises online

- Assess feasibility for solar

- Discuss installation preferences

Step 2: Your Utility Bill Analysis

- We can begin with a single bill

- You can provide interval data that will allow us to develop a more accurate proposal

Step 3. your cost savings proposal

- Specific savings projections

- Insights into usage patterns

- Recommendations for other savings measures

Stop paying for high energy bills and join the hundreds of businesses that have gone solar with Sunistics.

If you’re searching for commercial solar installers in California, start with Sunistics and we’ll get you a proposal within a few days!